Condo Insurance in and around Greenville

Looking for excellent condo unitowners insurance in Greenville?

Condo insurance that helps you check all the boxes

Home Is Where Your Condo Is

Often, your home base is where you are most able to recharge and enjoy family and friends. That's one reason why your condo means so much to you.

Looking for excellent condo unitowners insurance in Greenville?

Condo insurance that helps you check all the boxes

Protect Your Home Sweet Home

We get it. That's why State Farm offers outstanding Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Jimmy Boling is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you want.

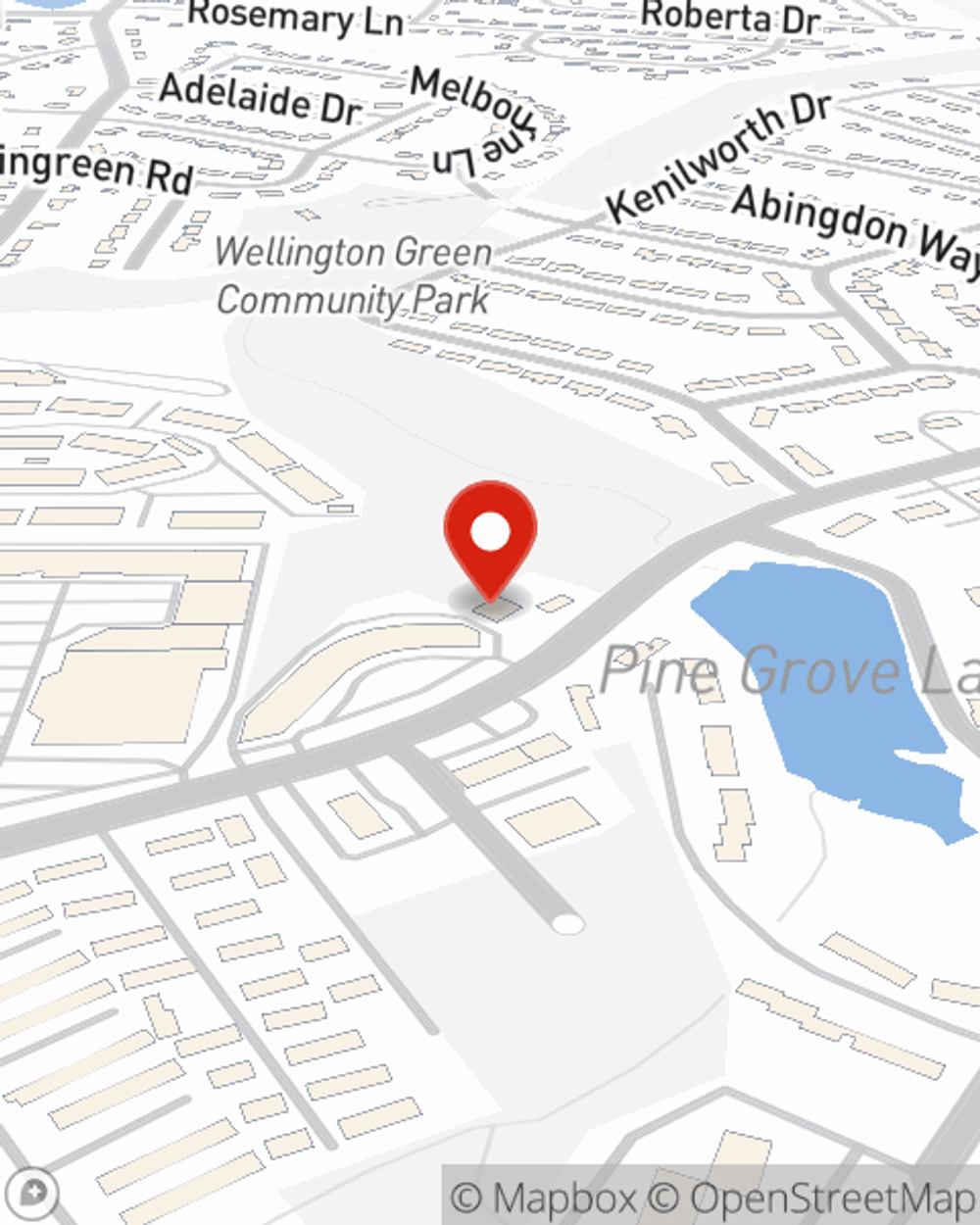

Ready to get going? Agent Jimmy Boling is also ready to help you discover what customizable condo insurance options work well for you. Get in touch today!

Have More Questions About Condo Unitowners Insurance?

Call Jimmy at (864) 268-0641 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Jimmy Boling

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.